More secure communication and data exchange for insurance companies.

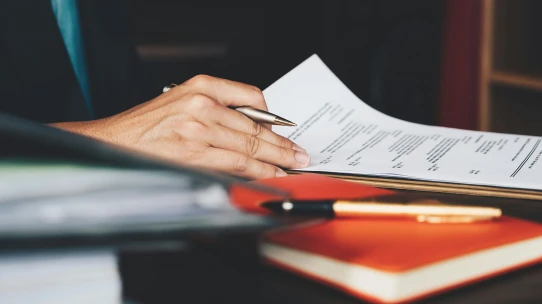

Share sensitive documents easily and securely with external recipients and encrypt emails and file attachments directly in Outlook or the browser without any IT knowledge.

Insurance companies work with a large amount of highly sensitive information every day – from customers’ personal data and financial information to health-related and medical data. This content is confidential, but must still be exchanged with different recipients. Especially in view of the advancing digitalisation, the issue of data protection when exchanging this sensitive information plays an important role for insurers. This is the only way to preserve the trust and security of customers, comply with legal requirements and ensure smooth business operations.

A data protection incident can not only result in high fines and legal consequences for insurance companies, but also damage a company’s reputation. In the EU, the protection of personal data is firmly anchored in the General Data Protection Regulation (GDPR). In addition, against the backdrop of increasing IT risks, legislators are responding with stricter requirements for the industry, in particular through the enactment of the Digital Operational Resilience Act (DORA). FTAPI supports the insurance industry in reliably protecting the exchange of sensitive information and thereby meeting insurance compliance requirements.

Data exchange for insurance companies in compliance with compliance requirements. Low administrative effort and full data sovereignty through transparency and traceability.

Secure & easy encryption

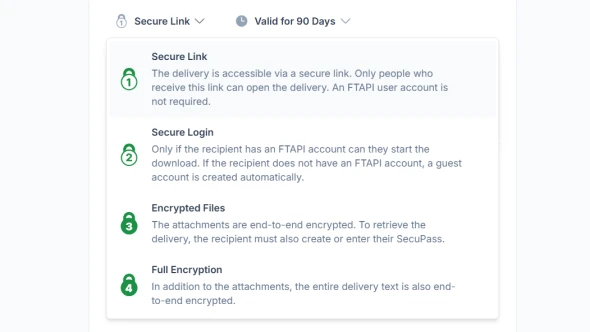

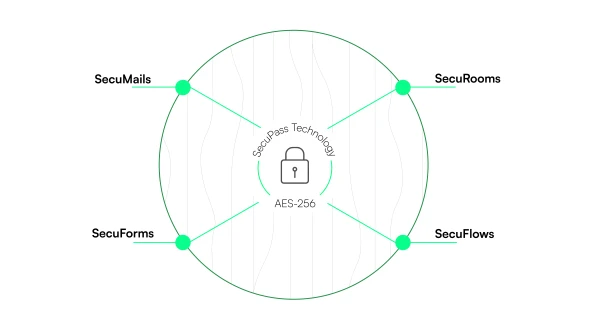

FTAPI provides a secure platform for the exchange of sensitive data. End-to-end encryption fulfils the data protection and data security requirements of DORA and GDPR.

Reliable access controls

With comprehensive authentication and access controls, FTAPI ensures that only authorised employees can access data, thus minimising the risk of data misuse.

Traceability

FTAPI enables comprehensive logging and traceability of all data transactions. This enables insurance companies and banks to carry out detailed documentation and audits.

Ensure data protection in many areas easily. Within organisations or in exchange with customers and partners.

Protection of sensitive data

Insurance companies regularly exchange customer data and other personal data with customers, banks, tax authorities and other institutions, for example for identification, contract processing or in case of queries. The products of the FTAPI platform ensure that this information remains reliably protected during transmission. This minimises risks such as data misuse, identity theft and much more, and reliably meets insurance data protection and compliance requirements.

Privacy guaranteed

Within the framework of health and life insurance, data are exchanged with doctors, hospitals, pharmacies and experts, for example for the assessment of claims or tariff setting. These data are subject to strict data protection regulations because they provide highly sensitive insights into privacy. The FTAPI platform provides a secure infrastructure for transmitting such information while fulfilling all data protection requirements, including the GDPR.

Fast replacement in case of damage

Contract documents, damage documents and expert opinions often contain confidential details about financial, legal or private matters. With FTAPI SecuRooms, these documents can be securely transmitted between insurance companies, customers, experts and workshops and archived in an audit-proof manner. For legal documents such as statements of claim, expert opinions or court records, protection against inspection by third parties is essential. Thanks to encrypted and legally secure communication, the confidentiality and integrity of these data are maintained.

Time savings through automation

Insurance companies regularly send sensitive contract information, such as leasing or policy documents, to their customers. This information is automatically read from the core system using FTAPI SecuFlows and then automatically and securely delivered to the recipient. This process saves time, minimises sources of error and ensures maximum security when transmitting sensitive information. This is how you can drive efficient digitalisation in the insurance industry.

Protect your customers’ sensitive data!

Find out more about secure email communication, file sharing, and automated workflows, and how to implement compliant data and document exchange.

Frequently asked questions about secure data exchange for insurance companies.

All the products on the FTAPI platform offer insurance companies the opportunity to exchange sensitive data (such as personal customer data, health data, contract documents, expert opinions, claim documents, and much more) in compliance with data protection regulations via intuitive user interfaces. FTAPI is certified according to the BSI criteria catalogue (C5). All the products on the data exchange platform offer end-to-end encryption, and all data are stored exclusively in certified German data centres. By using the FTAPI platform, compliance and data protection issues in insurance can be easily implemented.

Yes. FTAPI offers specialised solutions for insurance companies to meet DORA requirements. FTAPI offers end-to-end encryption and GDPR-compliant products for the exchange of sensitive data and protects insurance companies from data misuse through authorisation management. In addition, detailed traceability of all data movements is provided to support audits.

Yes. With FTAPI SecuFlows Advanced, insurance companies can not only protect their data exchange but also automate it. In this way, recurring data exchange processes, such as the sending of policy documents, can be automated and securely mapped. The use of FTAPI therefore offers the potential to actively shape the efficient digitalisation of the insurance industry.

Find out more.

Blog

More efficient data exchange thanks to DORA.

Discover how insurance companies can use DORA requirements to make their processes more secure and much more efficient.

Application

Secure data exchange: reliably compliant.

Transfer sensitive data securely encrypted, GDPR-compliant and user-friendly at the same time with FTAPI.

Whitepaper

Secure data exchange for insurance companies.

Learn how to meet the compliance requirements of DORA and how to balance resilience and efficiency.

Product

A platform for your secure data exchange.

Emails, data rooms, automation - discover how you can securely exchange your data at any time with FTAPI.